Sea freight: large shipments sail from Belgium to your destination!

Traditionally, when someone thinks of an international move from Belgium, they think of sea freight transport. Sea freight, for a long time, was the only option one had to move their belongings from one continent to another. Our expertise in sea freight ensures that your larger shipments are moved efficiently and securely, making sea freight a preferred option for substantial international moves. We are active in the BeNeLux-region, the northern part of France and the western part of Germany and ship to any location in the world.

Are you looking for a sea freight from Belgium?

How we handle your sea freight

For small volumes, air shipments are often cheaper than sea shipments, so we calculate every option to get you the best deal on a shipment. Here, we will delve further into how we handle sea shipments.

- We use an international specialised consolidator network for our sea shipments. For large palletised or crated sea shipments, we look for the best rates available on sea freight and delivery services. This extensive network allows us to offer competitive pricing and reliable scheduling for your sea freight needs.

- We offer two main options:

- Door to port: Where we ship up to the port of destination. The correct incoterm is DEQ (Delivered Ex Quay), in a warehouse in the port of destination. All the handling, custom clearance, etc. as from arrival are for your account.

- Door to door: Where we deliver in your new residence. The correct incoterm is DAP (Delivered at Place), all the normal destination services are coordinated by a local international mover, and your shipment is delivered in your new residence.

- We come to your residence and collect the boxes, suitcases, bikes, …, and whatever else you want to ship. We can also do the packing. In our warehouse, we prepare your shipment with labels and documentation.

- We have weekly sailings. When you choose the option ‘Door to port’, we deliver you the bill of lading, that’s the proof of ownership of the goods, and with that, you can contact the port agent mentioned on the document and start the process of obtaining your shipment.

- With a door to door option, all the destination services are coordinated by our partner overseas, a well-established international mover.

Let us ship your start to a new life

In conclusion, sea freight is an invaluable option for transporting large volumes across continents. Whether you’re looking for a door to port or door to door service, the comprehensive sea freight solutions from our experienced international moving company are designed to meet your needs. Are you interested in exploring the options for your next international move? Our team is dedicated to providing you with the best sea freight solutions, tailored to ensure your shipment arrives safely and efficiently at its destination. Request your quote today.

Are you ready to embark on your international move with confidence?

Sea freight shipment, step by step

[expand title=”Read more”]

STEP 1: The quote

You want to receive a quotation, please fill out the quotation form.

• Make sure you understand the quote correctly and have asked us for the right volume. The final price is dependent on the volume.

• The volume is calculated in cubic meters (m³) = 35,3cuft.

STEP 2: The booking

• We have already completed the booking form attached with your quote with the information provided to us. Please complete this form and send it back to us. Upon receiving your booking we will confirm this.

• Ordering packing materials, pickup date, …, all comments can be left on this booking form.

STEP 3: Boxes and packing

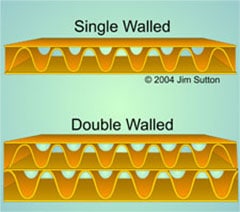

• When packing your shipment consider that you use a sturdy box. A well packed box should with stand a fall from 1m. high on any surface or rib without damage to the box or its content. We advise double walled boxes, certainly for fragile items and heavy boxes (+15 kg). Clothes and other non-fragile items can be shipped in single walled boxes.

• You can use any size box you like. Boxes /suitcase can be of different dimensions. It’s better to ship two small boxes over 1 big box.

• For each box you need to make a detailed and valued inventory. We can provide you with an example Excel file that you can alter to your needs.

• Make sure you do not pack any items that are listed as ‘dangerous’ or ‘forbidden’. Customs can inspect your shipment and remove these items and levy a fine.

STEP 4: Documentation

• Your shipment will need proper documentation for customs.

• You will need to provide us with these documents:

- The booking confirmation form

- Detailed and valued inventory

- Passport copy (+Visa if applicable)

- Insurance list (if you need insurance)

- Customs forms (USA, Australia, … we will send you the forms if applicable)

STEP 5: Pick up and payment

• Our driver normally collects your boxes from a ground floor/front door level. Please make sure the boxes are prepared. Unfortunately the courier cannot wait for last-minute packing if not advised on beforehand. Collections other than ground floor need to be requested, a small fee is charged.

• If you choose full packing by our services, our crew will bring all packing materials and pack on the day of pick up. Please arrange for ample parking space in front of the residence.

• Your goods will be brought back to our warehouse and measured/weighted for invoicing. You will receive an invoice and weight ticket. On request cash payments to the courier are possible. You will receive the invoice by e-mail, our banking details are on the invoice

STEP 6: Shipping and delivery

• After receiving your payment your goods will be send to destination.

• When you chose the ‘door to port’ option you will receive a bill of lading after departure of the vessel. With this you can custom clear and obtain your goods.

• When you chose the ‘door to door’ option you will be contacted by our destination agent when the goods are about to arrive at the port of destination. the destination agent will custom clear and deliver.

[/expand]

For more information or questions please check our FAQ for sea freight.